When Keiko Pun graduated in 2017 from City University of Hong Kong, she aspired to use her degree in environmental science and management to create what she called “positive impact.”

She landed a job a year later at China Road and Bridge Corporation, one of the world’s largest civil engineering contractors, where she was in charge of reducing the environmental impact of an infrastructure project in Hong Kong’s Tseung Kwan O district. Opportunities soon came knocking, as companies and consulting firms sought talent to fill their ranks in environmental, social and governance (ESG).

“The whole market is paying attention to [ESG issues],” said Pun, who joined the consultancy BDO in late 2020 as an associate in the Hong Kong ESG services team and got promoted last year. “I thought this field offers more potential for my career growth, so I made the change.”

Pun is one of the hundreds of ESG professionals receiving training from Hong Kong’s tertiary institutions, as the city transforms itself into a regional centre for ESG services to sharpen its edge in banking and finance, logistics and supply chain management. The qualification is in hot demand – commanding 25 to 40 per cent salary premiums, recruiters said – as Hong Kong has raised the bar for banks, publicly listed companies, asset managers and insurers to comply with ESG disclosure requirements by 2025.

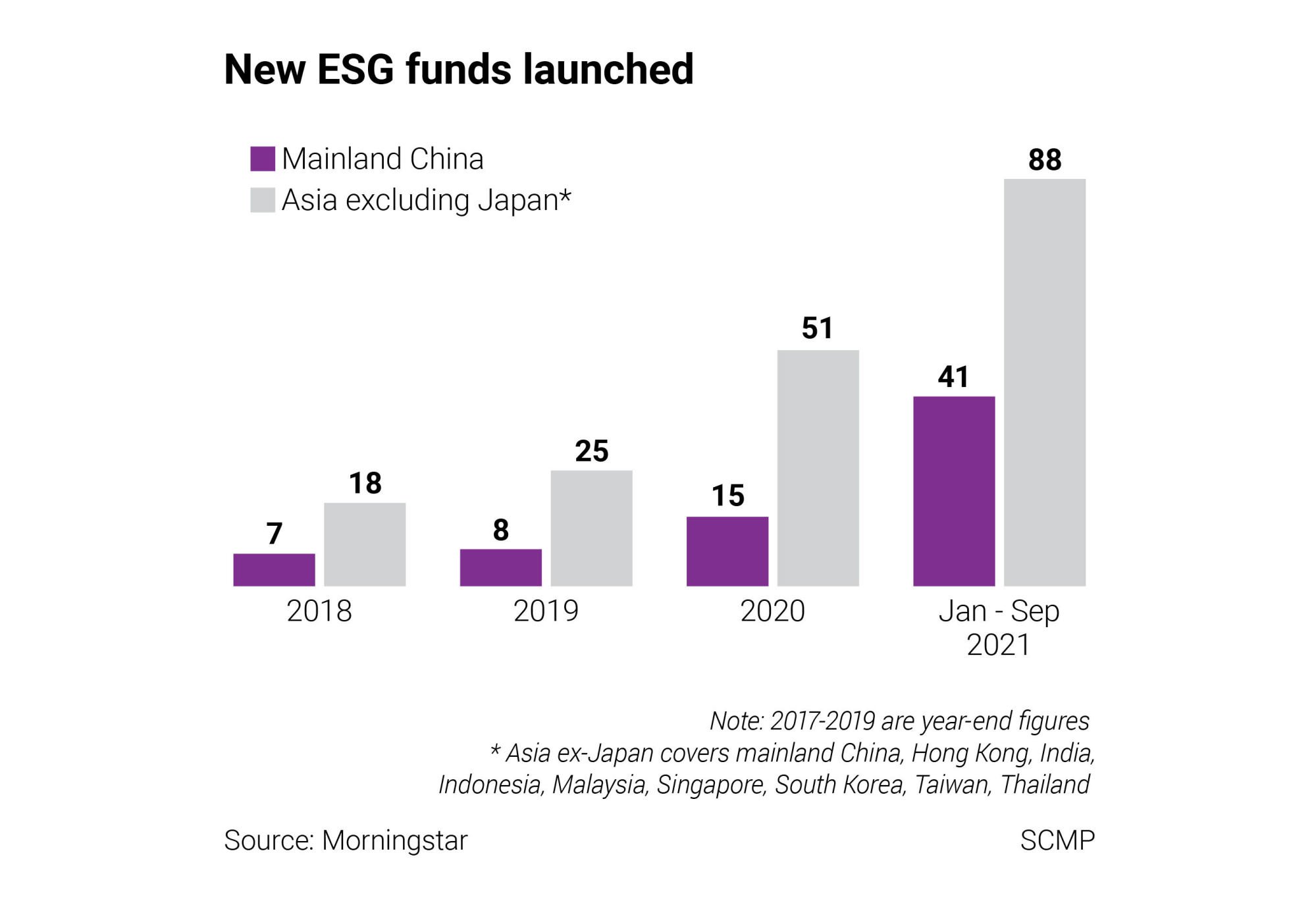

New ESG funds launched in Asia. Source: Morningstar

Under ESG rules, companies must add environmental, social and governance factors to the financial metrics of their business operations in regulatory disclosures, and consider both in strategic and capital allocation decisions. As many as 2,586 publicly listed companies, licensed banks and asset managers will have to set up ESG-related positions – or outsource them to consultants – by 2025 in Hong Kong, based on the sum total of institutions under the purviews of various regulators.

“The talent pool for ESG professionals everywhere, including Asia and Hong Kong, is not deep,” said John Mullally, Robert Walters’ director of financial services for Southern China and Hong Kong. “A lot of money will need to be invested on new hires and training over the next few years. Finding those individuals with direct experience, knowledge, credibility and qualifications within a short space of time is difficult.”